Semiconductor supply problems are having a huge impact on the automotive sector in Europe. Analysts at Allianz Trade estimate that the semiconductor crisis will cost Europe around €100 billion and Poland €2.2 billion over the period 2021-2022.

As vehicles will absorb more and more semiconductors, the automotive sector will need policy support to avoid greater losses in the future. At the same time, Allianz Trade notes that support should focus on segments where Europe is both a large manufacturing and end market, namely automotive, rather than consumer electronics.

Unexpected demand return

The automotive industry has become a major victim of the global semiconductor crisis. At the beginning of the pandemic, in preparation for hard times, automakers and automotive suppliers responded with deep cuts in inventory and semiconductor orders. When demand for cars returned faster than expected in the second half of 2020, the industry saw chipmakers shift capacity to end markets with booming demand, such as computers and data centers, leaving little capacity for the automotive sector.

Europe must react

Nearly two years after the first signs of a semiconductor shortage, car production remains well below 2019 levels, with a total global production shortage of more than 18 million vehicles. The situation is relatively worse in Europe, where – unlike in China or North America – vehicle production fell to an unprecedented low of 13 million vehicles in 2021. After signs of improvement at the end of 2021 and in the first quarter of 2022, the recovery in production was again hampered by additional tensions in the supply chain caused by blockades in the Shanghai region and Russia’s invasion of Ukraine.

EU chip production is the key element

While the root causes of the decline in global car production are common to all regions, significant divergence in regional performance is evident. Allianz Trade, comparing the stability of the number of cars registered with chip production capacity at the regional level, observes a positive and strong correlation indicating how critical local chip production is to maintaining car production.

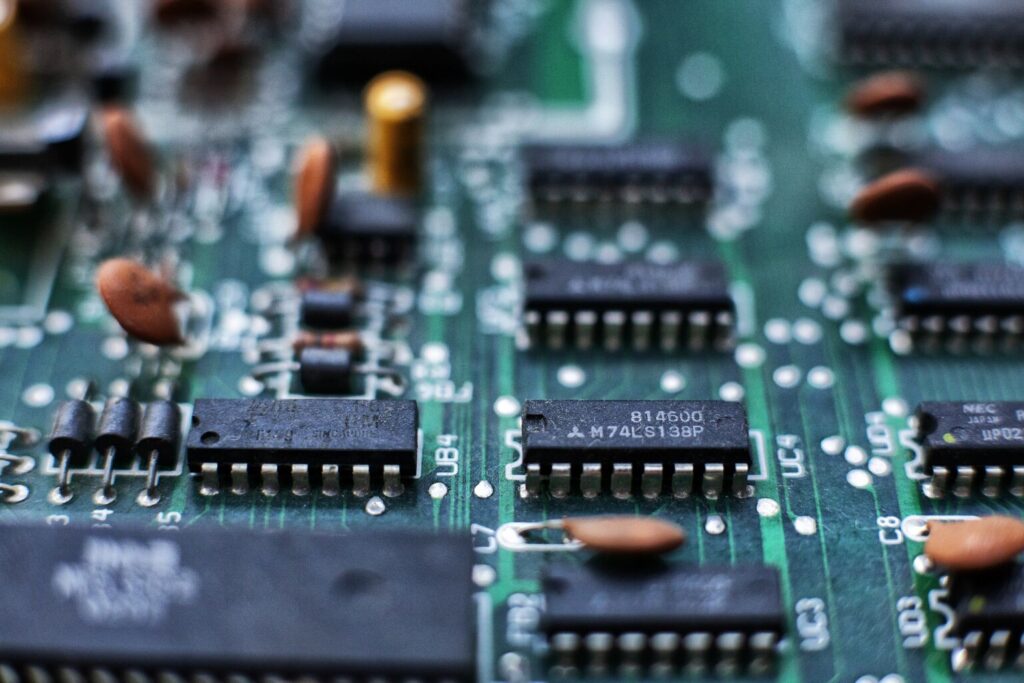

Europe’s weakness is all the more frustrating because the production of most automotive chips is based on proven manufacturing technologies. Unlike the computing or memory chips found in smartphones and computers, which use the most innovative manufacturing technologies (“nodes”) available only in Taiwan and South Korea, automotive chips are based on mature nodes introduced in the 1990s and 2000s – reads an analysis by Allianz Trade.

Costly lack of integrated circuits

How much did the shortage-induced crash cost the European economy? To find out, lost output was measured, comparing production in 2021 and 2022 to 2019 levels. Given the dynamics of overall consumer spending on goods during this period, it was assumed that demand would have been similar to 2019, had supply allowed for it.

We can then read that: „In order to convert lost production into lost added value, the average added value generated for each car produced in Europe was calculated.”

Allianz Trade calculations show that more than €50 billion, or the equivalent of 0.4% of the region’s GDP, has already been lost in 2021. Assuming European production declines by another -1% in 2022, another €47 billion could be lost, bringing the total to €98 billion. Germany would see the largest losses (€47.5 billion in lost value added in 2021 and 2022), as its automotive sector accounts for the major part of total added value. On the other hand, record low inventory levels at retailers suggest that there could be strong growth potential if production resumes in 2023.

Europe will still be at risk

From an analysis of the longer-term outcome, European supply chains will continue to be at risk as semiconductors become ubiquitous. Vehicles need more and more semiconductors due to three factors:

- Connectivity (i.e., more chips to keep cars connected via WiFi to the manufacturer’s network and drivers’ phones via Bluetooth, etc.).

- Safety (motion sensors, blind spot object detection, etc. require chips).

- Electrification (electric cars contain twice as many semiconductors as internal combustion engine cars).

Over the past 10 years, the value of semiconductors per car has more than doubled to more than $600 globally. Given the European mix (safer, more connected, greener than the average car), the value for Europe is most likely higher.

Support focused on quick targets

As we wrote in 2021, semiconductor autonomy is far beyond Europe’s reach. However, policymakers can provide targeted support with a few things in mind. – Allianz Trade analysts point out. At the same time, they point out that support should focus on segments where Europe is both a large manufacturing and end market, i.e. automotive, rather than consumer electronics.

In their view, currently the motivation to „attract investors” willing to build production facilities is low. What is needed, therefore, are natural and economically justified incentives to help increase the share of industrial- and automotive-grade semiconductor production. Europe is home to three of the world’s largest automotive-grade semiconductor companies, which benefit from a combination of external (in Asia) and in-house, often European, production. „Policymakers should tilt the scales in the right direction to make local investment more valuable than outsourcing in Asia” – the analysis concludes.